The 25% Rule: The Gold Standard for Financial Peace of Mind

Let’s talk about the number one question I get when someone’s just beginning their journey into physical metals: “How much should I own?”

At St. Joseph Partners, we typically recommend allocating 20–25% of your net worth into physical gold and silver. That surprises people. Some think it’s too high. Others wonder how we got to that number. So let me break it down in plain English.

What Is Net Worth Anyway?

Your net worth is just what you own minus what you owe.

It includes things like:

- Your savings and checking accounts

- Retirement accounts (IRAs, 401ks)

- Real estate and vehicles

- Investment portfolios

- Precious metals you already own

Subtract your debts (like a mortgage or credit cards), and what’s left is your total net worth.

So when we talk about putting 20–25% of your net worth in metals, we’re not talking about going all in. We’re talking about making sure a meaningful piece of your financial foundation is grounded in something real and historically resilient.

But Why 20–25%?

This isn’t just a “gut feeling” or industry slogan—it’s backed by decades of hard data. Financial professionals use something called the Sharpe Ratio to measure the strength of a portfolio. It looks at how much return you're getting for every unit of risk. In other words, it helps answer this question:

“Is this portfolio smart and stable, or risky and unpredictable?”

And here’s what the numbers show:

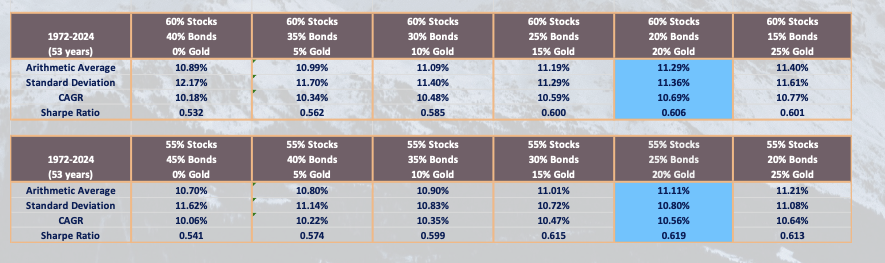

From 1929–2024, portfolios were optimized with 15% gold

From 1972–2024, once gold started trading freely, the ideal was 20%

Since 2000, the Sharpe Ratio peaks at 25% gold

So in all of modern investing history, when gold is included properly, risk-adjusted performance improves.

"I Already Own Some Gold—Is That Enough?"

A lot of people reading this might say, “I already bought some gold, so I’m good, right?” Yes, owning something is better than owning nothing. But if you’re only holding 3%, 5%, or even 10% in metals, that’s not enough to truly hedge your wealth.

Think of it like fire insurance: Owning a fire extinguisher doesn’t mean your house is protected. You need enough coverage to matter. Most portfolios today are still overloaded with paper assets—stocks, bonds, mutual funds, and dollars. If the system wobbles, all of that is affected. But gold and silver don’t move in lockstep with those assets—and that’s exactly why you need them.

This Isn't About Fear—It’s About Financial Stewardship.

Gold and silver are not just investments—they’re anchors. They’re not flashy, and they won’t double overnight. But they’ve never gone to zero. And in times of chaos, they become the safe haven people run to. In fact, one of the most meaningful things I’ve learned working with clients is this:

Peace of mind doesn’t come from how much you have. It comes from knowing what you have is real, resilient, and within your control.

A Quick Note Before You Act

As always, this isn’t personal financial advice—it’s simply what history, data, and our real-world experience have shown. If you’re working with a financial advisor, we’re always happy to coordinate and answer any questions they may have.

So What Should You Do?

Start by looking at your overall picture. If you’re not near that 20–25% mark, let’s talk. There are smart, tax-advantaged ways to build your metals position slowly and intentionally—across both your retirement and taxable accounts. Whether you’re starting with $5,000 or $500,000, the principles are the same. Preservation comes first.

Here’s to asking good questions, learning something new, and keeping your financial footing solid no matter what surprises the world has in store.

Have a question for a future Ask Becca? Send it my way at info@stjosephpartners.com—I’d love to hear from you!

Until next time, Becca

Past performance is not indicative of future results.