What Financial Advisors Won’t Tell You

While only 2% of U.S. financial advisors recommend gold allocations, central banks are rapidly increasing their gold reserves. A record amount of gold was purchased in the first half of the year, as central banks shift away from U.S. dollar-denominated assets. What else aren’t financial advisors telling you about?

Important events are happening in the silver market. Like gold, silver has been a currency for centuries, dating back to 600 B.C., with its U.S. history rooted in the Constitution, establishing gold and silver as the only legal money.

Until the 1960s, America’s middle class thrived, saving in silver-backed currency. By saving $500 per year, a family could accumulate $10,000 over two decades, redeemable in silver at any U.S. bank. The significance of these savings, as protected by the Constitution, was that factory workers, farmhands, teachers, and firemen could all enter any U.S. bank and redeem their wealth in silver. However, President LBJ broke the constitutional mandate by replacing silver dollars, drastically reducing the purchasing power of savings. LBJ consciously lied to the American people, saying that dollars would maintain value as silver had done for patriots, when he knew there wasn’t any historical precedent that supported the truth of his words.

If a family had saved $10,000 in silver-backed dollars in 1964, it would be worth over $200,000 today. In contrast, $10,000 saved in paper dollars would now be worth just $715, showing how silver has maintained value while paper currency did not. LBJ’s lie goes down as one of the most devastating lies told to the American working class.

In addition to its historic role as a stable currency, silver stands out from gold due to its suitability for smaller transactions. Looking ahead, we expect silver’s performance to be even more noteworthy than it has been since 1964, fueled by growing industrial demand, particularly in green technologies.

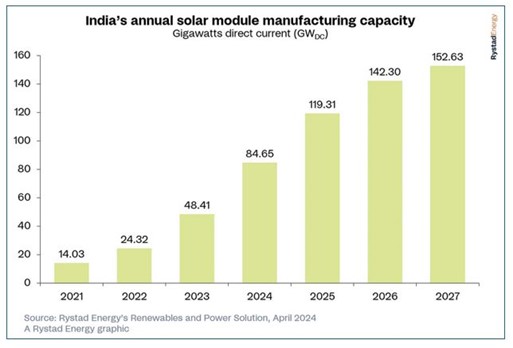

Silver is essential for green technologies like solar energy. Solar panels accounted for 14% of silver demand in 2023, and that figure is growing. Despite efforts to replace silver in solar, no other element provides similar attributes at the same price point. In fact, the amount of silver used in high-quality solar panels has more than doubled. India, historically one of the world’s largest silver consumers and silver investors, is set to double its imports in 2024, underscoring silver's rising industrial demand and significance globally.

Power grid construction demands, fueled partly by surging interest in AI, also increase the demand for silver given silver’s role in computing hardware.

Adding fuel to the fire, automotive electrification also drives silver demand. Auto analysts have referred to today’s cars as “computers on wheels,” and some estimates suggest today’s cars require one kilo of silver each. There is speculation about a new Samsung EV battery that could replace lithium with silver, but we do not have proof of that being ready for market yet. If true, it would mark another significant industrial demand for silver. Regardless of the numerous incremental and exciting uses for silver, given current uses, silver is on track for its fifth consecutive year of supply deficit as the demand continues to outpace mining production.

Remarkably, silver is still priced below its 1980 inflation-adjusted peak even though some nations have even proposed adding it to their critical minerals list due to its industrial importance. Before the silver ship sails in the investment market, we suggest it may be wise to stockpile silver along with your gold allocations.

As the list of nations moving towards BRICS and away from the petrodollar continues to expand, there is a growing urgency for Americans to diversify away from dollars into gold and silver.

We offer investors the full line of silver from the world’s leading government mints, including U.S. Eagles, Canadian Maple Leafs, and Austrian Philharmonics. We also offer clients the ability to invest in bars made by private manufacturers.

For investors wishing to maximize their silver via small, easily recognizable form factors of silver, we offer a proprietary line of silver rounds made at our ISO9001-certified mint, where we are committed to bringing manufacturing jobs back to the heartland of America. Rounds include America’s most storied designs from the Walking Liberty to the Buffalo and our designs honoring Jesus.

Our Jesus Round is inscribed only with the words “Praised be Jesus”, proclaiming the gospel with the three most important words in English. The round depicts the moment in time as the Library of Congress described, where heaven appeared to George Washington and America’s fortunes in the Revolutionary War reversed from imminent defeat to historical victory.

Silver, alongside gold, is ideal for family portfolios, preserving wealth in a tangible currency that history shows will gain demand as the dollar weakens.

Feel free to call us at 610-326-2000 for an obligation-free consultation to discuss investing in precious metals as a hedge in your portfolio away from the financial markets. We can help you invest via home delivery, vault storage, or to protect your retirement account, whether it be an annuity or an IRA.

Thank you, and God bless.