BRICS+ Set to Disrupt Global Finance—Here’s What You Need to Know

In just a few weeks, the BRICS+ nations are set to unveil plans that could disrupt the global financial system. With talks of a new currency and payment system to rival the US dollar, this upcoming summit could mark a major shift in global trade and finance.

What does this mean for your wealth and investments? As BRICS+ challenges the dollar's dominance, gold, silver, and emerging markets may surge. Discover how these changes could impact you and what steps to take to safeguard your financial future.

One of the most significant developments leading up to the summit in Russia (October 22-24) is the agreement on a new settlement currency called “The Unit,” which will be traded over Project mBridge, a cross-border payment system of Central Bank Digital Currencies (CBDCs). This will compete with the SWIFT system, which is dependent on the fiat US dollar.

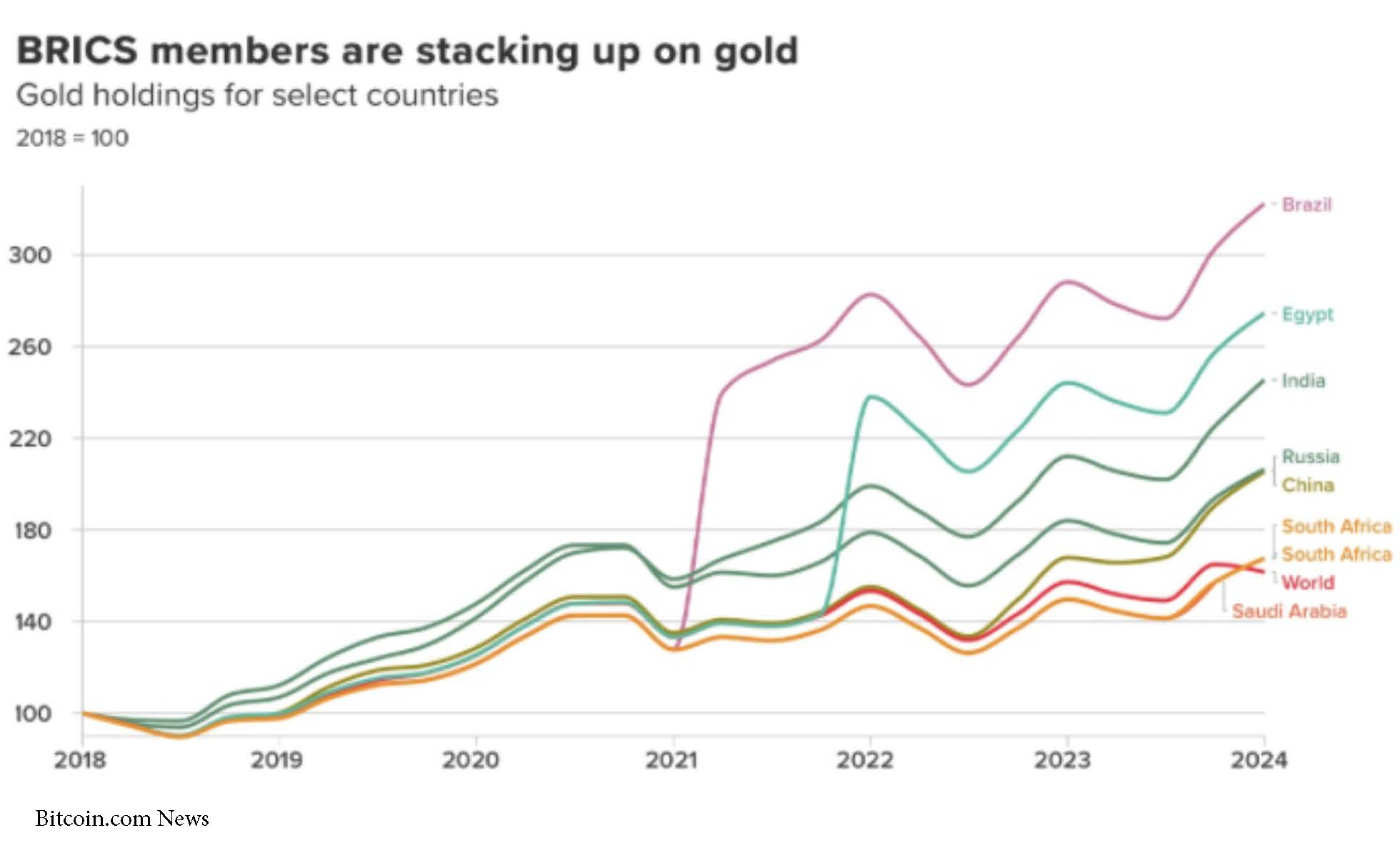

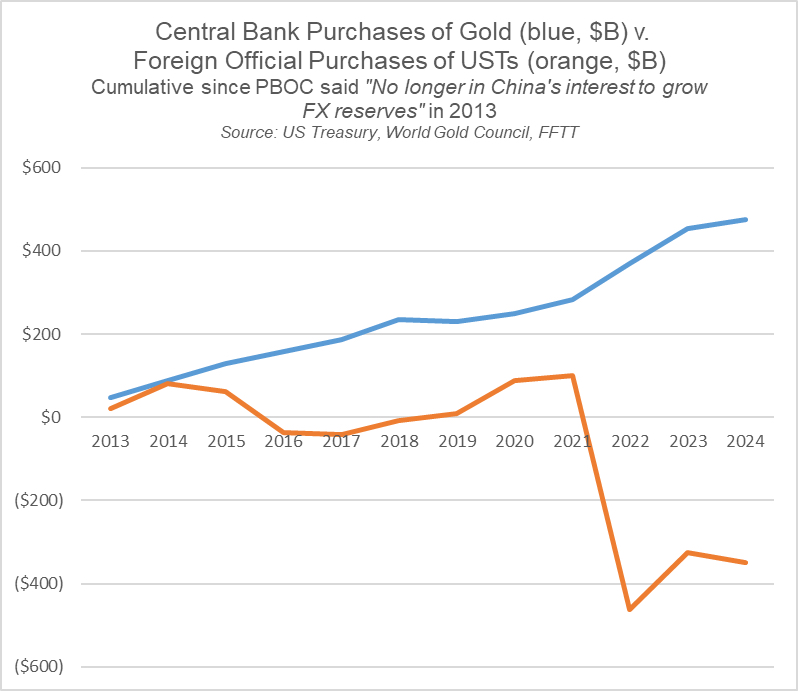

The ‘Unit’ is projected to be a basket of 60% BRICS+ currencies and 40% gold kilo bars, deliverable upon request. This may explain the significant increase in gold purchases by BRICS central banks. Over 4,000 tonnes of gold have been purchased by the BRICS nations' Central Banks in the last 28 months, and they have sold $800 billion in US Treasury securities within the same time frame.

Operation Sandman, a coordinated effort to disengage from the US dollar, has seen momentum in recent years. The latest country to seek membership is Turkey, making it the first NATO nation to do so—likely not the last. Predictions suggest that over 59 countries have applied to join BRICS.

Operation Sandman, a coordinated effort to disengage from the US dollar, has seen momentum in recent years. The latest country to seek membership is Turkey, making it the first NATO nation to do so—likely not the last. Predictions suggest that over 59 countries have applied to join BRICS.

The number of Western trading nations that exclusively use the dollar is significantly dwindling. Notably, Saudi Arabia's recent decision to sell oil in currencies other than the dollar marks a pivotal shift away from the petrodollar, signaling a potential decline in their allegiance to the US. Furthermore, Saudi Arabia has reportedly acquired 160 tonnes of gold in Switzerland since 2022.

This development raises serious concerns about the future value of the dollar. How did we reach this point, and what steps can we take in response?

Historically, currency serves as a means of exchange, with commodities like livestock, grain, and spices used in the past. For currency to retain its value, it must be in constant motion; otherwise, it risks becoming obsolete. The purchasing power of a currency is highly liable to change.

In contrast, money has intrinsic value. The dollar, while a currency, is merely a representation of value backed by the “good faith and credit of the US.” Over time, fiat currencies have evolved but often been mismanaged by governments grappling with spiraling deficits, overwhelming debt, and devaluation.

In 1944, The Bretton Woods System devised by Allied nations, decided upon a regulated system of fixed exchange rates, disciplined by a US dollar tied to gold at the time. On Aug. 15, 1971, the US suspended the convertibility of US dollars to gold, which ended the Bretton Woods system, rendering the US dollar a fiat currency.

Shortly after in 1973, the US made a secret deal with Saudi Arabia to trade oil only in US dollars, pegging the US dollar to oil - the beginning of the petrodollar (Notably Russia has recently begun trading oil for gold).

Currently, both the petrodollar and the dominance of the US dollar face unprecedented challenges. Since 2001, BRICS—now known as BRICS+—has been steadily positioning itself to lead emerging economies in the global financial arena. Their objective is to create a new currency that can rival the US dollar and establish a blockchain-based payment system.

This new reserve currency would be backed by a mix of member currencies and gold, potentially diminishing the demand for the US dollar and impacting both the US and global economies. US foreign policies have pushed BRICS nations to reduce their reliance on the dollar.

Although it is speculative that BRICS+ may emerge with such a currency soon, the potential for a bull market in gold from the adoption seems significant, especially with the weakening dependence on the dollar. Recently, currencies aligned with the BRICS nations are faring better than those tied to the US.

In the future, BRICS plans to incorporate a blockchain-based payment system known as the BRICS BRIDGE multisided payment platform, which would be an alternative for cross-border payments that are presently dominated by US dollars in the SWIFT program. Currently, the dollar still dominates foreign reserve holdings, and a BRICS currency undermining such dominance will depend on its ability to be adopted and perceived as stable.

The upcoming BRICS+ convention is just one month away and upwards of 59 nations have applied for membership, with some seeking confidentiality in their bids to shift away from the dollar.

This agenda poses a currency risk for the dollar’s value. Staying informed about these developments is crucial for those looking to hedge against potential declines in the dollar.

Investing in gold and silver is a straightforward way to protect yourself and those you love from the potential decline of a fiat currency.

Feel free to call us at 610-326-2000 for an obligation-free consultation to discuss investing in precious metals as a hedge in your portfolio away from the financial markets. We can help you invest via home delivery, vault storage, or to protect your retirement account, whether it be an annuity or an IRA.

Thank you, and God bless.