The Choice is NOT Bitcoin OR Gold – It’s Both

As we navigate an increasingly complex financial landscape, the debate between Bitcoin and gold has gained significant traction. Both assets have secured places in the portfolios of forward-thinking investors, yet they represent fundamentally different approaches to wealth preservation and growth. Anyone who frames Bitcoin and gold as an either-or choice of investment doesn’t understand either asset. They are not the same, nor are they interchangeable.

The Future: A Balanced Approach

Looking ahead, the optimal strategy may involve a balanced approach to Bitcoin and gold. Bitcoin offers the potential for high-risk, high-reward opportunities but remains in its early stages as an asset class. Its volatility, coupled with the threat of regulation and competition from CBDCs, makes cryptocurrency better suited for speculative investors who understand the risks.

Gold, by contrast, remains the foundation of wealth preservation. As a tangible asset with intrinsic value, it provides stability and protection in a diversified portfolio, particularly in the face of rising inflation and economic instability.

For investors seeking both immediate and long-term success, embracing both assets may be key—leveraging Bitcoin’s growth potential while relying on gold’s enduring security. In today’s reimagined financial systems, a blend of the old and new, such as Bitcoin and gold, offers an effective strategy to navigate complexities.

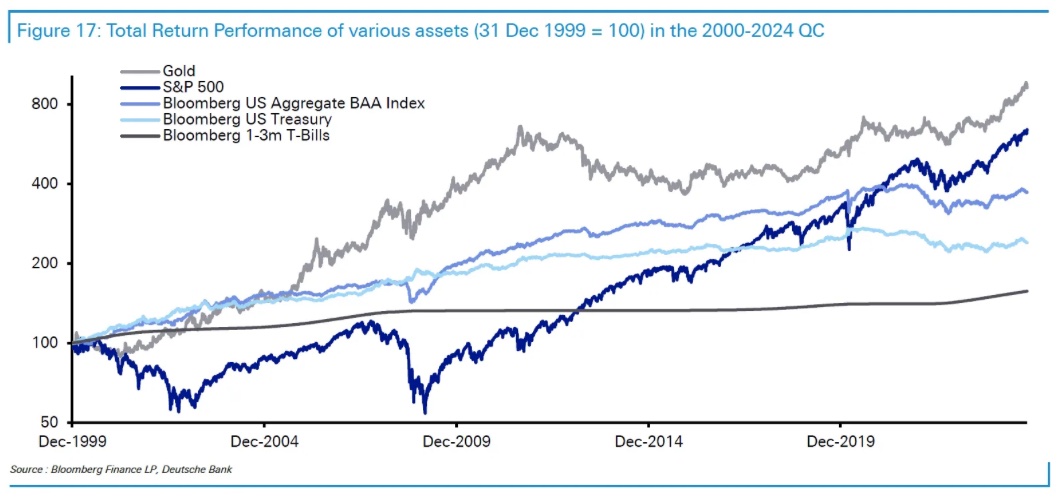

However, don’t count gold out for near-term success either. Gold has returned an average appreciation of 8% per year since gold began trading freely, and an average appreciation of 9% per year since 2000.

Gold: A Timeless Safe Haven

In stark contrast to Bitcoin, gold remains the ultimate store of value. With over 3,000 years of history as a hedge against currency devaluation and economic instability, gold continues to be the asset of choice for wealth preservation, particularly during times of crisis.

Unlike Bitcoin, gold is a tangible, physical asset with intrinsic value, universally recognized as a safe haven in periods of geopolitical and financial uncertainty.

As central banks worldwide expand their balance sheets and print money to address rising national debt and inflation, gold’s importance as a hedge against fiat currency erosion grows. Many central banks are once again adding to their gold reserves as a safeguard against economic turbulence and Goldman Sachs is recommending gold going into 2025.

Gold's enduring appeal lies in its independence from government or central bank policies. Even as the world increasingly embraces digital currencies, gold remains an anchor in shifting financial systems. With some European nations even exploring a return to the gold standard, gold’s relevance in the global financial system is likely to grow in the years to come.

Bitcoin: The Digital Revolution with Volatility

Bitcoin, the pioneering cryptocurrency, continues to dominate conversations as a potential hedge against traditional fiat currencies. Recently, influential figures like Donald Trump, a known cryptocurrency advocate, have highlighted Bitcoin as a modern alternative to traditional money. Its decentralized nature and growing acceptance as both a store of value and a speculative asset have fueled its rapid price increases, attracting investors seeking high returns.

However, Bitcoin remains a highly volatile and speculative investment. While its rapid price surges grab headlines, sharp declines frequently follow, making it a risky option for long-term investors. Additionally, its reliance on technology creates potential vulnerabilities, including cyberattacks, fraud, and regulatory scrutiny.

As governments around the world explore Central Bank Digital Currencies (CBDCs), Bitcoin’s role as a decentralized alternative may face challenges from these government-backed digital currencies.

Despite these risks, Bitcoin holds undeniable appeal. Its status as the "gateway" to the broader cryptocurrency ecosystem—offering privacy and self-custody—positions it as a unique and transformative asset in the evolving financial world.

UBS Confirms Gold is a Better Hedge than Bitcoin

UBS, one of the world’s largest investment banks, recently weighed in on the growing prominence of Bitcoin and its relationship to gold.

UBS Wealth Management’s Chief Investment Officer stated that while Bitcoin has garnered significant attention, its volatility makes it unsuitable for most investors. He emphasized that gold should remain a cornerstone in portfolios, especially for risk-averse clients.

Deutsche Bank’s recent report highlights gold as one of the best-performing mainstream assets of this millennium’s first quarter.

While Bitcoin’s appeal as a digital asset cannot be ignored, gold remains a steadfast anchor in any diversified portfolio. Both assets have their roles and understanding how they complement one another will be critical for investors aiming to thrive in a rapidly changing financial landscape.

Take this opportunity to call our team and discuss how physical gold can be part of your portfolio today – (610) 326-2000.

Thank you, and God bless.